social security tax limit

Thus an individual with wages equal to or larger than 147000 would contribute 911400 to the. At what age while on social security is there no limit.

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

2022 Social Security Earnings Limit A Real-Life Example of the Social Security Income Limit in Action.

. Wage Base Limits. This amount is also commonly referred to as the taxable maximum. Their income used to determine if Social Security benefits are taxable 28000 is less than the taxable Social Security base amount 32000 for joint filers.

Rosie is 64 years old. This amount is known as the maximum taxable earnings and changes each year. 55 rows Maximum Taxable Earnings.

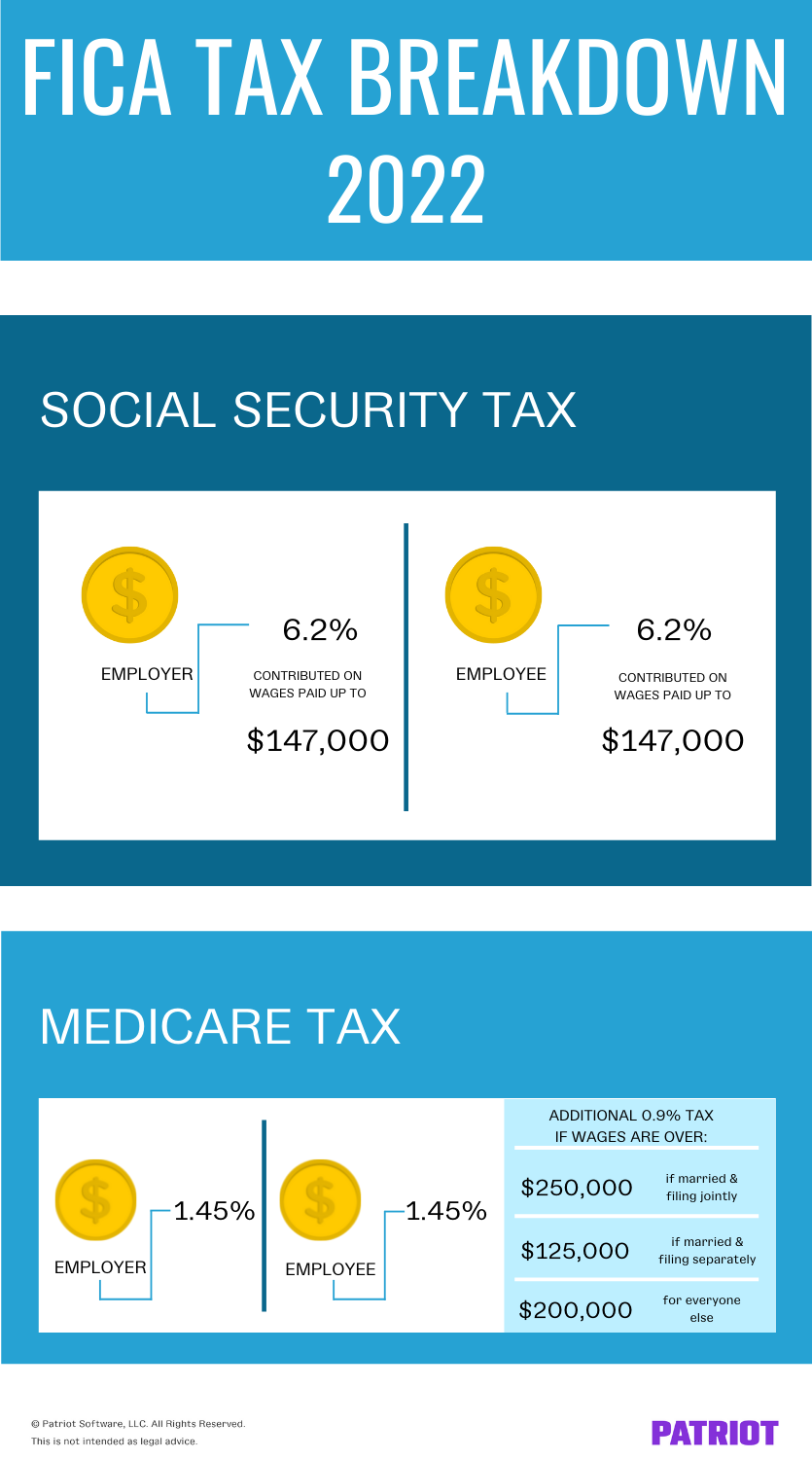

The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. How much is Social Security tax. The other payroll tax is a Medicare tax of 145 and youll have to pay that.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. To put these numbers into context lets look at an example of how this might work in a real-life scenario. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits.

The Social Security Expert can help with that. If they are single and that total comes to more than 25000 then part of their Social Security benefits may be taxable. Just a few quick questions to understand your situation better.

For earnings in 2022 this base is 147000. Keep in mind that this income limit applies only to the Social Security or Old-Age Survivors and Disability OASDI tax of 62. The Social Security taxable maximum is adjusted each year to keep up with changes in average wages.

Tax Tip of the Day. The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each.

Only the social security tax has a wage base limit. For earnings in 2022 this base is 147000. An estimated 15 million taxpayers did not file a 2018 tax return to claim tax refunds worth more than 15 billion.

Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. The wage base limit is the maximum wage thats subject to the tax for that year. The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher.

We call this annual limit the contribution and benefit base. Read More at AARP. This means that you will not be required to pay any additional Social Security taxes beyond this amount.

As a result in 2021 youll pay no more than 9114 147000 x 62 in Social Security taxes. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. If they are married filing jointly they should take half of their Social Security plus half of their spouses Social Security and add that to all their combined income.

The three-year window of opportunity to claim a 2018 tax refund closes on. The Social Security tax limit in 2021 is 885360. The maximum earnings that are taxed have changed over the years as shown in the chart below.

Up to 50 percent of your Social Security benefits may be subject to income tax if your combined income MAGI plus one-half your Social Security benefits exceeds 25000 for an individual filing single unmarried head of household or qualified widow er with dependent 32000 if married and filing jointly. Up to 85 of Social Security benefits are taxable for an individual with a combined gross income of at least 34000 or a couple filing jointly with a. In 2022 the Social Security tax limit is 147000 up from 142800 in 2022.

The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2022 will be 9114. In 2021 this limit is 147000 up from the 2020 limit of 142800. If that total is more than 32000 then part of their Social Security may be taxable.

If Social Security is your sole source of income then you dont need to file a tax return - but other forms of income are taxable. If you earned more than the maximum in any year whether in one job or more. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

John and Betty file a joint tax return. 9 rows If you are working there is a limit on the amount of your earnings that is taxed by Social Security. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits.

None of their Social Security benefits are taxable. When does the 50 tax go away. Refer to Whats New in Publication 15 for the current wage limit for social security wages.

Or Publication 51 for agricultural employers. The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages. No Tax Knowledge Needed.

Social Security Benefits How Much Can I Actually Get Marca

What Is Social Security Tax Calculations Reporting More

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Social Security Wage Base Increases To 142 800 For 2021

Did You Know Even As Your Social Security Tax Has A Limit There Is No Limit To The Amount Of Medicare Taxes If Y Tax Help Business Goals Profitable Business

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Social Security How Much Can Draw Upon And Earn In 2022 Is There A Limit As Com

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Fica Tax Guide 2021 Payroll Tax Rates Definition Smartasset

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

What Is The Social Security Tax Limit Social Security Us News

What Is The Social Security Tax Limit Social Security Us News

Ncpssm Payroll Taxes Payroll Social Security

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age